As the United Arab Emirates (UAE) continues to evolve into a global economic powerhouse, understanding consumer spending trends is crucial for businesses looking to succeed in this dynamic market. In 2024, the household disposable income in the UAE is forecasted to reach an impressive US$270.30 billion, highlighting the substantial purchasing power of its residents. With consumer spending expected to amount to US$210.00 billion, businesses must keenly observe and adapt to the evolving spending habits of UAE consumers.

A Snapshot of Spending Patterns

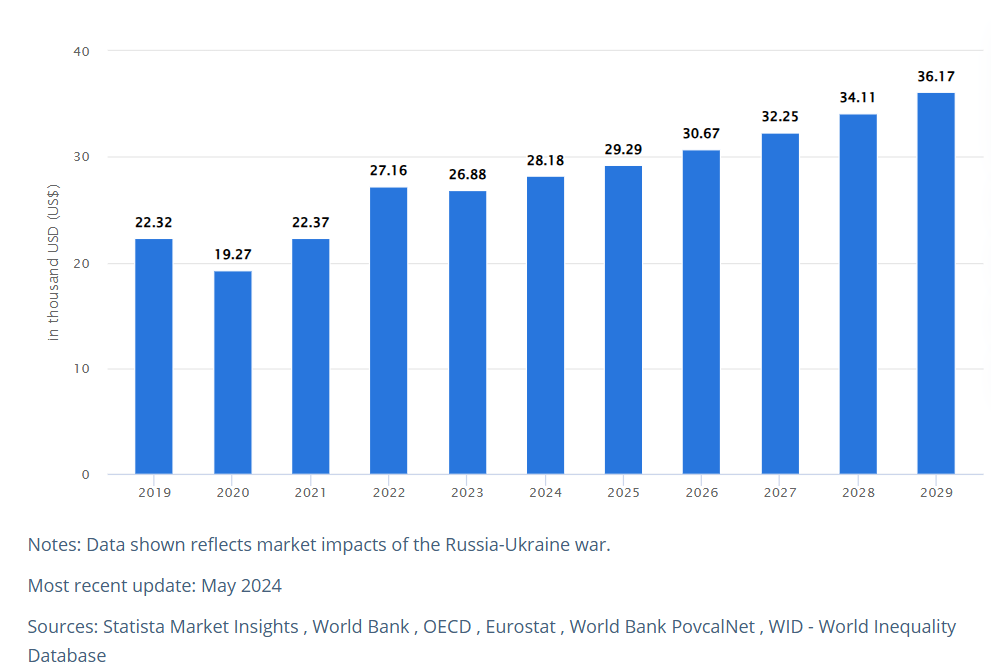

UAE consumers are known for their high disposable income, with a per capita figure forecasted at US$28.18k in 2024. This financial capacity translates into significant expenditure across various sectors. Notably, a large portion of consumer spending is directed toward essential categories such as housing, food, and healthcare. The forecasted per capita spending on housing in 2024 is US$5.07k, while spending on food and non-alcoholic beverages is projected at US$7.10k. Healthcare, an increasingly important sector, is expected to see a per capita spend of US$1.06k.

UAE Disposable Income per Capita

Interestingly, UAE consumers also prioritize lifestyle and leisure. With per capita spending on culture and recreation expected at US$0.53k and hospitality and restaurants at US$0.95k, it is evident that leisure activities play a significant role in the daily lives of residents. This trend is further supported by the per capita spending on clothing and footwear, which is anticipated to reach US$0.97k in 2024, reflecting the UAE’s status as a fashion-forward market.

The Role of Technology and E-commerce

Technology and e-commerce are playing an increasingly influential role in shaping consumer spending trends in the UAE. The widespread adoption of smartphones and the internet, coupled with a robust e-commerce infrastructure, has made online shopping an integral part of the consumer experience. The UAE leads the Gulf Cooperation Council (GCC) states in e-commerce, with the market experiencing a remarkable 53% surge in 2020, reaching a record US$3.9 billion in sales, which constituted 10% of total retail sales. Dubai, in particular, is at the forefront of this growth, with forecasts predicting that the market in Dubai alone will generate US$8 billion in sales by 2025.

The integration of augmented reality (AR) and virtual try-ons in online shopping is revolutionizing how consumers engage with fashion and beauty products. These technologies allow consumers to make informed purchase decisions, reducing return rates and enhancing customer satisfaction. This trend, combined with the rise of Research Online, Purchase Offline (ROPO) and Buy Online, Pick-up In-Store (BOPIS) strategies, reflects the merging of online research with offline purchases, a significant shift in consumer behavior.

The Impact of Luxury and Personalized Services

Luxury spending remains a defining characteristic of consumer behavior in the UAE. Dubai alone accounts for 30% of the Middle East’s luxury market, with citizens spending approximately 30% of their monthly salaries on luxury goods. This affinity for luxury is not just about the products but also about the experience. UAE consumers expect personalized services that cater to their individual needs and preferences. Businesses that invest in personalized customer experiences and exclusive rewards are more likely to win the loyalty of these high-spending consumers.

Conclusion

Understanding consumer spending trends in the UAE is key to capitalizing on the vast opportunities this market presents. With a high disposable income, a penchant for luxury, and an increasing reliance on technology, UAE consumers offer a lucrative market for businesses that can meet their evolving needs. By focusing on personalized services, leveraging technology, and catering to the demand for both essentials and luxury, businesses can position themselves for sustained growth in the UAE’s dynamic economy.